child tax credit portal phone number

The Child Tax Credit for tax year 2021 is up to 3600 per child under 6 and 3000 per child age 6-17. Here is some important information to understand about this years Child Tax Credit.

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

Dear Connecticut Resident Thanks to a new federal law the American Rescue Plan most families in Connecticut with children under 18 are now eligible to receive Child Tax Credit payments of between 250 to 300 per month per child or up to 3600 per child per year.

. You will reach an IRS assistor who can. The Child Tax Credit CTC provides financial support to families to help raise their children. You do not need to have a job or income to claim this credit.

500 per dependent for the 1st stimulus because my daughters godmother claimed her for 2020. If you are calling the CRA on behalf of someone else you must be an authorized representative. Yukon Northwest Territories and Nunavut.

Eligible families will receive advance ChildTaxCredit payments of up to 300 for each child younger than age 6 and up to 250 for each qualifying child ages six to. Families eligible for the expanded Child Tax Credit CTC dont have to wait until they file their taxes in 2022 to start getting payments. The Administration collaborated with a non-profit Code for America.

The IRS has not announced a separate phone number for child tax credit questions but the main number for tax-related questions is 800-829-1040. Heres how to schedule a meeting. When you claim this credit when filing a tax return you can lower the taxes you owe and potentially increase your refund.

Choose the location nearest to you and select Make Appointment. For all other languages call 833-553-9895. By making the Child Tax Credit fully refundable low- income households will be.

If you cant find the answers to your tax questions on IRSgov we can offer you help in more than 350 languages with the support of professional interpreters. What other information is helpful for your refundable credit outreach education and tax preparation efforts. The credit was made fully refundable.

If you received any monthly Advance Child Tax Credit payments in 2021 you need to file taxes this year to get the second half of your money. Our phone assistors dont have information beyond whats available. Information from previous benefit payments.

I have received all three stimulus payments which equal to 3200 I did not get the additional payments for dependents ex. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying children under age 18. Now through the Child Tax Credit Update Portal families can change the information the IRS has on file by updating the routing number and account number and indicating whether it is a savings or checking account according to a news release.

The IRS used the information from your 2019 or 2020 tax return to estimate your eligibility for monthly Child Tax Credit payments in 2021 and send payments equal to half of the amount of Child Tax Credit that the IRS. But there is a catch. Dial 18001 then 0345 300 3900.

These updated FAQs were released to the public in Fact Sheet 2022-29PDF May 20 2022. You will get half of this money in 2021 as an advance payment and the other half in 2022 when you file a tax return. File a 2021 tax return by April 18 2022 to claim the CTC for 2021.

Use our contact form to let us know. For example if you call the IRS business phone number you wont get the answer youre looking for as the representatives at the end of the line arent going to have them. But theres a catch.

The rest of your Child Tax Credit will be issued in one payment. The deadline to sign up for monthly Child Tax Credit payments is November 15. Under the Child Tax Credit children who are 6 or younger should receive 300 per month while children ages 6 to 17 will receive 250 per month.

The number to try is 1-800-829-1040. What other materials and information would help you assist individuals and families who may qualify for EITC AOTC and the Additional Child Tax Credit. Request for Transcript of Tax Return.

Head to the IRS Taxpayer Assistance Tool page and enter your ZIP code. The Child Tax Credit provides money to support American families. For assistance in Spanish call 800-829-1040.

Request for Taxpayer Identification Number TIN and Certification Form 4506-T. The amount you can get depends on how many children youve got and whether youre. Before calling just a warning the IRS has already advised citizens it is dealing with extraordinary backlogs overwhelming phone calls and not enough staff to deal with the procedural demands of.

Hi everyone if anyone can kindly give me any insight it will be very appreciate it. Make sure you have the. Call the IRS about your child tax credit questions from the below phone number.

The child needs to younger. Already claiming Child Tax Credit. Filing a tax return is how you can tell the government about your family and the number of qualifying children you are claiming.

You can also use Relay UK if you cannot hear or speak on the phone. The first that your entire payment has to go to one account. The credit amount was increased for 2021.

Find answers about advance payments of the 2021 Child Tax Credit. Do you have best practices to share. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child.

If you got advance payments of the CTC in 2021 file a tax. Making a new claim for Child Tax Credit. To get started you can call 800-829-1040 to reach the tax agency about an issue youre having with your child tax credit payment.

Parents and relative caregivers can get up to 3600 per child for tax year 2021 from the new CTC. Personal details about the children in your care. Instead of calling it may be faster to check the.

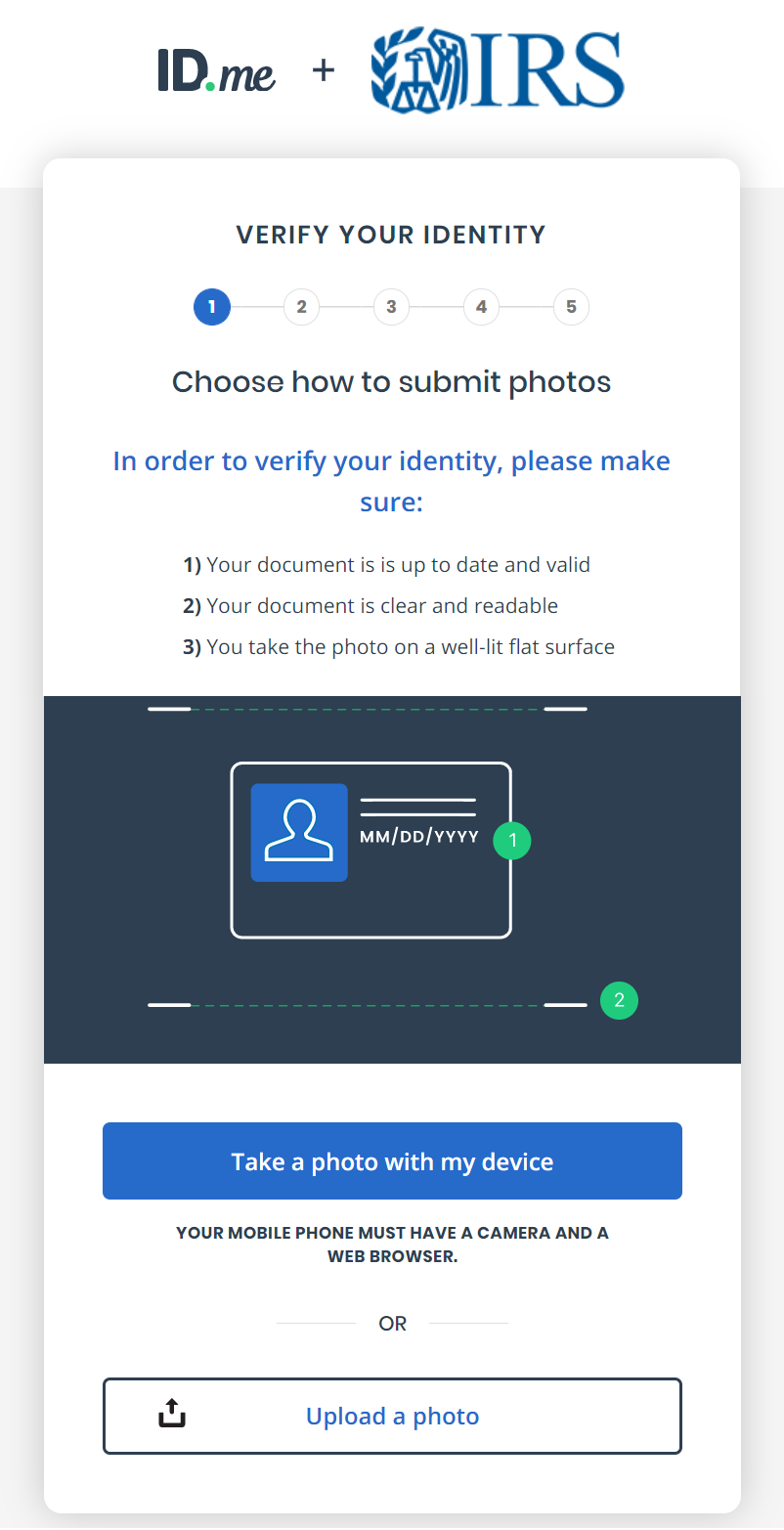

To verify your identity youll need.

Tax Consultation With An Tax Expert Over A Phone Eztax India Income Tax Return Tax Refund Friday Motivation

Ramsey Smarttax Vs Turbotax Tax Software Turbotax Money Goals

Taxes For Teachers And Educators Great Ways To Boost Your Tax Refund Https Youtu Be Ltbfards8wy Tax Refund Teachers Tax Money

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Childctc The Child Tax Credit The White House

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Xne Financial Advising Tax Preparation By Xne Financial Advising Llc Via Slideshare Tax Preparation Financial Social Media

Tax Consultation With An Tax Expert Over A Phone Eztax India Tax Tax Reduction Filing Taxes

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Pin By The Taxtalk On Income Tax In 2021 Tax Refund Income Tax Chartered Accountant

Tax Compliance Calendar For Fy 2019 20 It Gst Tds Eztax In Filing Taxes Compliance Tax Services

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

White House Unveils Updated Child Tax Credit Portal For Eligible Families

Pin By Karthikeya Co On Tax Consultant Tax Deducted At Source Tax

Gst Refund Process 2 Income Tax Tax Refund Income Tax Return

Mismatch In Input Tax Credit Books Vs Gst Portal Tax Credits Tax Credits